October 30, 2020 | By Edward Townley, Founder, Cogent9 Consulting

We use relative value units (RVUs) in many aspects of our practices. Some physician compensation arrangements are based on RVUs; other practices use them for staffing models and productivity measurements. Where did RVUs come from and how have they evolved over time?

Beginning in 1985, William C. Hsiao PhD, professor of economics at Harvard’s H. T. Chan School of Public Health, assembled a team of statisticians, measurement specialists, economists and physicians to review national data on medical procedures and services. The team specifically evaluated the resources and costs associated with each service and determined a method to compare one service to another.

The results were published in the Journal of the American Medical Association (JAMA) on Sept. 29, 1988.1 The Harvard Resource-Based Relative Value System (RBRVS) study was submitted to the Health Care Financing Administration (HCFA), the precursor agency of the current Centers for Medicare and Medicaid Services (CMS) the same year.

In December 1989, President George H. W. Bush signed the Omnibus Budget Reconciliation Act of 1989, which switched Medicare reimbursement from the somewhat arbitrary Usual, Customary and Reasonable (UCR) system to the Resource-Based Relative Value System. This became effective Jan. 1, 1992.

The system is primarily based on the AMA’s Current Procedural Terminology [CPT] code set, with added codes for new technology and services. The Specialty Society Relative Value Scale Update Committee (also known as the RUC) determines the RVUs for each new code and revalues existing codes on a five-year schedule to reflect changes in costs and technology.

Each CPT/HCPCS code is assigned values for the physician work component, the practice expense required to provide the service, and the cost of its associated malpractice insurance. Geographic variations in staffing expense and practice overhead are adjusted by another factor. Malpractice insurance expenses vary widely across medical specialties. Figuring out how to calculate all of these variables is a little easier than it might appear.

RVU Components

Three separate RVUs are associated with calculating a payment under the Medicare PFS:

- The physician Work (W) RVU reflects the relative time and intensity associated with furnishing a Medicare PFS service

- The Practice Expense (PE) RVU reflects the costs of maintaining a practice (renting office space, buying supplies and equipment, and staffing costs)

- The Malpractice (MP) RVU reflects the costs of malpractice insurance

Each of these three RVU values has an adjustment applied for the variations in the costs of practicing medicine in different areas within the country. These adjustments are called Geographic Practice Cost Indices, [GPCIs], and each kind of RVU component (W, PE, MP) has a corresponding GPCI adjustment.

Finally, to convert these values to a payment amount (in dollars) for a particular service, the sum of the geographically adjusted RVUs is multiplied by a Conversion Factor [CF] in dollars. Medicare annually specifies formula by which the CF is updated on an annual basis.

For 2020, the CMS Medicare Physician Fee Schedule [MPFS] Final Rule set this value at $36.09, which was up a tiny amount from the 2019 value of $36.04.

For 2021 the proposed CY 2021 MPFS conversion factor is $32.26, a decrease of $3.83 (-10.6%) from the CY 2020 PFS conversion factor of $36.09. This key factor reduction will affect all codes across the Medicare Physician Fee Schedule.

The RVU equation, then, is

Payment = [(Work RVU x Work GPCI) + (PE RVU x PE GPCI) + (MP RVU x MP GPCI)] x CF

Confused yet? Let’s use the tables2 to look at a few familiar codes. For these calculations, we will use 2020 RVU, GPCI and CF values available on the CMS website (link in footnotes).

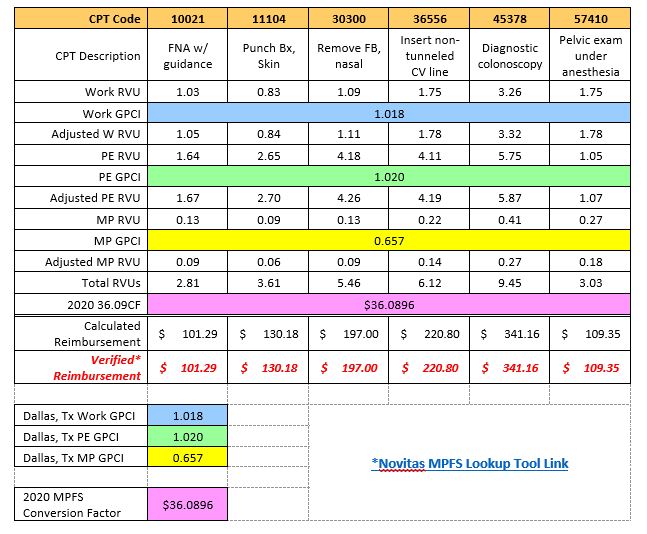

For CPT 10021 [Fine Needle Aspiration Biopsy, Without Guidance, First Lesion] the following RVUs are assigned.

- (Physician) Work = 1.03

- Practice Expense = 1.64

- Malpractice Expense = 0.13

Now we have to determine the GPCI for our location. For the sake of this example we will look at the GPCI values from Dallas, Texas. The MAC code is 04412 Novitas, the locale code is 11 for Dallas.

- W GPCI = 1.018

- PE GPCI = 1.020

- MP GPCI = 0.657

The 2020 Conversion Factor, as stated above, is $36.09.

Plugging in these values into our equation would then look like this:

[Work (RVU 1.03 x GPCI 1.018) + PE (RVU 1.64 x GPCI 1.020) + MP (RVU 0.13 x GPCI 0.657)] x CF ($36.09)

Geographically adjusted RVUs are then [Work (1.049) + PE (1.673) + MP (0.085)], which sums to 2.807.

(Values are shown rounded to 3 decimal points; full actual values used in calculations)

Multiplying this with the current year Conversion Factor of $36.09 yields a calculated reimbursement of $101.29.

We can check this calculation by checking the CMS or Novitas MPFS Lookup Tools3. This verifies the calculated amount of $101.29 is correct. We can then compare the calculated value with the reimbursement listed in the current MPFS.

Looking at this one and a few other familiar codes in a spreadsheet format:

Most managed care plans use some modification of these RVUs to calculate reimbursement, typically as some multiplier of the Medicare rate, such as 150% of Medicare. If you know the data elements of RVUs, GPCIs and the conversion factor, the equation is straightforward and easy to use.

You can see that the RVU calculations have a great importance for knowing and forecasting reimbursement amounts for individual CPT codes.

————————-

- Hsiao, William (October 28, 1988). “Results, Potential Effects, and Implementation Issues of the Resource-Based Relative Value Scale”. Journal of the American Medical Association. 260 (16): 2429–2438. doi:1001/jama.260.16.2429.

- CMS RVU Files https://www.cms.gov/apps/physician-fee-schedule/search/search-results.aspx?Y=0&T=2&HT=1&H1=77427&H2=77301&H3=77334&H4=77336&H5=G6002&M=1

- Novitas MPFS Lookup Tool: https://www.novitas-solutions.com/webcenter/portal/MedicareJH/FeeLookup?_afrLoop=648707163347645#!%40%40%3F_afrLoop%3D648707163347645%26_adf.ctrl-state%3D18ic3ghbvj_55