February 10, 2023 | By Grant Huang, CPMA, CPC

The realm of E/M auditing is vast, and 2023 will bring more work here than before thanks to CPT’s extensive revisions to its E/M guidelines for inpatient, facility, and home visit services — now in effect. Both compliance professionals and providers must always keep in mind that E/M services (which account for a third of annual Medicare Part spending) will go from being a perennial easy target to an urgent area of attention in 2023. For healthcare payers, the new changes represent an undiscovered country of shifting utilization patterns and potential overpayments, just waiting to be identified and seized.

Targeted audits save time but have limits

A targeted audit is based on a non-random sample of E/M claims, chosen for a specific reason. This reason is typically because payers are signaling that certain codes are of interest to them, or you have benchmarking data that shows certain codes are being utilized in a way that makes the reporting providers appear to be statistical outliers.

For this tip, let’s consider the use of benchmarking to target our E/M audits. You can obtain benchmarking data directly from CMS, which releases a massive database file each year to the public, known as the Provider/Supplier Procedure Summary (P/SPS). If you aren’t a database wizard who can whip up spreadsheet formulas and macros in a pinch, you may find this raw government difficult to apply. Fortunately, there’s a free tool developed by The Frank Cohen Group, the analytics division of DoctorsManagement, that we release each year when CMS releases its most recent P/SPS file. This is known as the National E/M Utilization Analyzer Workbook , and it contains the national version of the P/SPS file, broken down by medical specialty.

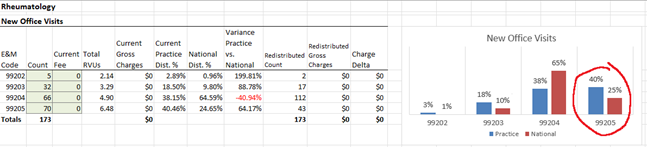

With this tool, you can punch in your provider’s utilization for specific E/M code ranges (e.g. initial hospital/observation care) and see how the resulting distribution graph compares to other providers of their same specialty nationwide, based on what those providers reported to Medicare contractors in 2021 (the most recent data year available). In the screenshot above, you can see that this rheumatology provider is billing a larger proportion of level 5 new patient visits than their peers, so 99205 would be a great code to review as part of a targeted audit.

Knowing about such outliers lets you narrow your audit resources to the code(s) in question. This saves you the time of looking at codes where their utilization is in line with their peers – but if you always rely on benchmarking, you might miss the bigger picture.

Random audits can still be useful

Remember, the purpose of the audit is to validate whether risk is present or not. You might consistently audit outlier claims only to find that the providers are always meeting documentation and medical necessity requirements. Your providers can rest easy knowing that when the inevitable payer audit comes, they’ll have nothing to fear. But you haven’t found any problem by doing this. That’s where random audits can help. They are naturally going to involve reviewing more E/M services which the provider is billing within the statistical norm. But appearing to blend in with the rest of the crowd doesn’t mean that the documentation for those services are guaranteed to be in great shape.

A random audit can also establish a baseline error rate for a provider, because the random sample is not biased towards outlier E/M services. If you only look at those cases most likely to be overcoded, you will emerge with high error rates that are not necessarily representative of the overall accuracy of a provider’s coding.

Conclusion: Choose your audit strategy wisely

Data mining and analytics are now so ubiquitous that even small practices have heard of benchmarking and can grasp the benefits. Thanks to free tools such as the National E/M Utilization Analyzer from DoctorsManagement (state-specific versions are available for purchase), any practice administrator, coder, auditor, compliance professional, or even provider can perform E/M benchmarking.

The key to getting the most out of benchmarking is knowing when to use it. Regular benchmarking against Medicare data is useful to aim your audits and save time, but won’t always give you a clear idea of a provider’s overall error rate. Random audits using a truly random sample of claims can more accurately find the error rate, and if done regularly over time, will arm you with historical data for providers that you can use to identify any deviations from their trends.

And of course, if you ever have a reason to suspect particular codes as being high risk (e.g., you receive documentation requests for certain codes), then a highly focused audit on those areas will be a useful response going forward.

Today’s tip provided by:

Grant is a compliance consultant at DoctorsManagement, LLC, and director of content for NAMAS. He has worked for years as a healthcare regulatory analyst and producer of educational content. He is also an AAPC-certified coder and auditor.

Your next steps:

- Contact NAMAS to discuss your organization’s coding and documentation practices.

- Read more blog posts to stay updated on the 2023 Revisions to the 2021 E&M Guidelines.

- Subscribe to the NAMAS YouTube channel for more auditing and compliance tips!