July 2, 2021 | By Pam Brooks, MHA, COC, CPC

As an auditor, you might find that the “meat and potatoes” of the audit is the most interesting part. Then you finish and it is time to pull together your findings into an executive summary.

The best and most effective executive summary design is a document that contains a concise narrative that represents the audit scope and explains the key points and recommendations; directed not only to the audit stakeholders but to their senior leadership as well. By following a basic outline and learning how to communicate your audit findings in a way that is clear and succinct, you can achieve this very important step in your audit process with ease.

Most executive summaries start out with an introduction that includes an overview of the auditor’s company or department mission statement and scope of work on company letterhead in a standard font. This sets the tone for the executive summary by saying, “here’s who we are and what we do”.

Next, outline the scope of your audit. Briefly discuss the reason for the audit request, including any concerns, questions, legalities, or other matters that were the catalyst for the audit. For example, you might perform an audit of E&M services reported on the same day as minor dermatology procedures because this topic has landed on the OIG work plan. This is the part of the summary where you can thank practice leadership, HIM, or other individuals who assisted you throughout your audit process.

Explaining the methodology of the audit is critical, particularly if you are going to be presenting this executive summary to individuals who will want assurance that your audit sample and process are statistically appropriate, or for those who are unfamiliar with “coder-speak”. Indicate how many and which specific services, providers, dates, payers, and any other criteria were chosen as relevant to the review. Note whether the sample size was targeted or random, and state which elements of concern were under review. Spell out acronyms that may be unfamiliar to administrative leaders and make sure you identify which resources or guidance supported your findings.

In the example used above, you could specify in your methodology that you have targeted those E&M services reported with a -25 modifier along with codes from the integumentary system. You can further indicate that you validated diagnosis and CPT code accuracy and that you referenced CCI edits and payer guidelines in order to determine if these pairs of codes were appropriately reported. Also explain how you structured your findings; by practice, by provider, or some other element of the review.

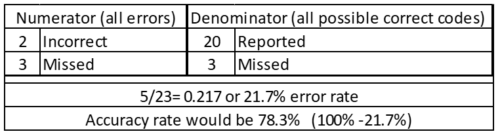

Group your audit findings according to the issues that you uncover and compare apples to apples. For example, if you have both over and under-coding of E&M levels as a finding, you should report those separately, but under the overall heading of “E&M errors”. Report diagnosis code errors based on those that were both missed and incorrect. Separate your CPT procedure findings from your E&M findings. Many organizations hold providers accountable based on the accuracy of their audit results, so it will be critical to understand how to calculate this percentage accurately. For example, “there were 20 CPT codes reported in the audit; two were incorrect and there were three missed codes”. The chart below illustrates how to calculate errors and missed codes into error or accuracy rates.

A brief and relevant section of the regulatory citation should be included as part of each finding. If you have a finding based on ‘best practice’ without regulatory guidance to support your rationale, say so. Professional opinions are certainly helpful in any audit report, but unless you uncovered a definite compliance issue, you may consider simply making your recommendation as a ‘suggestion’.

Link each corrective action plan recommendation you provide to the specific finding in your review. Perform a root cause analysis when you uncover audit findings so that you can direct your recommendations to the appropriate person. In our audit example, you’ve discovered that 10 of the cases reviewed had an inappropriate -25 modifier appended. In your recommendations for a corrective action plan, you suggest additional training for the coding team. However, you later learn that a back-end billing function appends that -25 modifier to an associated procedure without any coding review. Your finding is correct, however the recommendation is of no use, and you have called out the coding team unnecessarily.

Be sure to list all resources at the end of each executive summary using the appropriate format. If there are questions or reluctance surrounding your recommendations, you have provided the regulatory guidance to support your findings. A good source for this is available through Purdue University at https://owl.purdue.edu/owl/research_and_citation/apa_style/apa_formatting_and_style_guide/reference_list_basic_rules.html.

Additionally, always provide a disclaimer within your executive summary. This demonstrates that you have performed the audit based on information and standards that were available and current at that time. A disclaimer is not going to protect you if you make an error, but it will validate last month’s audit if the guidance changes this month.

Finally, your executive summary must be professionally written with no spelling and grammatical errors. Communicate in ‘third person’, state only relevant information, and leave out any personal opinions. Unless the audit reviews a single provider, individual names do not belong on your executive summary. If writing is not your ‘thing’, consider taking a technical writing course. Writing an effective executive summary is the culmination of a great deal of auditing work, but it is not an impossible task and enhances your reputation as an auditor.