April 8, 2022 | By Sean Weiss, CHC, CEMA, CMCO, CPMA, CPC-P, CMPE, CPC

Four months into 2022 and the question is: How far along is your audit of high, medium, and low-risk services? If you are like most practices or health systems, something always gets in the way and causes audits to take a back seat; however, if you have truly created a “culture of compliance” regardless of what it is that’s happened, nothing should get in the way of doing your diligence and working towards ensuring as many protections as possible are in place.

The real question is: What should you be auditing? The problem is that most practices’ auditing departments are like sheep following a leader off the cliff. Now, I get it, that is a bit of a harsh statement, but the reality is you get your auditing goals each year from things you read in an industry newsletter or from a friend that works at another organization (practice, hospital, health system, etc.) who is auditing a specific group of services. No two organizations are alike and as a result, no two audit plans should be alike. Your audits should be based on several things, including:

- The OIG Work Plan / OIG Advisory Opinions or OIG Fraud Alerts.

- If you participate with Medicare or Medicaid any and all Program Alerts, National Coverage Determinations (NCD), or Local Coverage Determinations (LCD) and/or Local Coverage Articles (LCAs) for the services you actually perform.

- If you participate with commercial payors (BCBS, UHC, CIGNA, Aetna, Humana, etc.) you should be pulling the services you most bill to these payors and audit against their internal medical policies or LCDs.

- Audit your high dollar as well as high-volume services.

I tell clients or groups I have the privilege of speaking for that the best practice when it comes to auditing is to run your provider productivity (utilization) reports out of your Practice Management System (PMS) and identify your top 10 to top 20 services and pull a sample for each of them.

What type of sample should you pull? Should it be statistically valid? A statistically valid sample is the last type of audit you should pull since those are typically used to extrapolate damages and/or for use in Self Disclosure Protocols (SDPs). Always get direction from counsel before proceeding with drawing a statistically valid sample. There are several types of audits samples/methodologies to choose from (Probability, Convenience, Random Number; Educational, etc.); you just have to determine the best fit for your purpose. Will you perform the audit as either prospective or retrospective? Again, the choice here is yours but there are pros and cons to each so make sure you get clear direction from counsel. Personally, I recommend retrospective audits because of the Affordable Care Act (ACA) and the 60-day rule for issuing refunds once an overpayment is identified and confirmed. A lot of folks think that by doing prospective audits, if they catch the mistake before the claims goes out the door and they fix it, there is no harm and no foul. That may be true, but what if the prospective review showed a high or sustained error rate? What does that mean for all the potential errors on those services that were not caught from past billings prior to the prospective review? Again, get with counsel to understand your liability.

Why does everyone choose 99214 when conducting an audit? While this code poses a risk to organizations, there are other CPT® codes; take 99213 for example. I believe this code poses more of a risk to providers. For example, most providers believe that an established patient with 1 chronic well controlled issue (HTN, DMII, etc.) and a statement of ‘continue with current medications’ constitutes a 99213- IT DOESN’T! I do not care how great your History and Exam are documented; the medical decision-making nor the “Medical Necessity” are there to support it. Providers say to me all the time, “I do some level four and five services, and I also do some level two services, so I just bill the code in the middle and that way I am off the radar!”. That could not be a more egregious act of fraud because you are acting with deliberant ignorance and reckless disregard of the truth, and these are litmus tests for prosecutors debating on whether to bring a civil/criminal compliant under the Federal Health Care Fraud Statute or The False Claims Act.

We live in a day and age where Whistleblower cases are running at a fevers pace and audits are being handed out like Metformin at a nursing home. In 2021, the DOJ recovered $5.4 Billion and of that amount, $5.1 Billion was tied to health care Fraud. Now, remove the big pharmaceutical settlements and the number is more in line with most prior years of approximately $2.5 Billion. Whistleblowers take this stuff seriously, so you need to perform audits that are relevant to the services you provide within your practice or organization based on specialty. Make sure to focus your attentions to not only the highest RVU services, but to those of the highest volume.

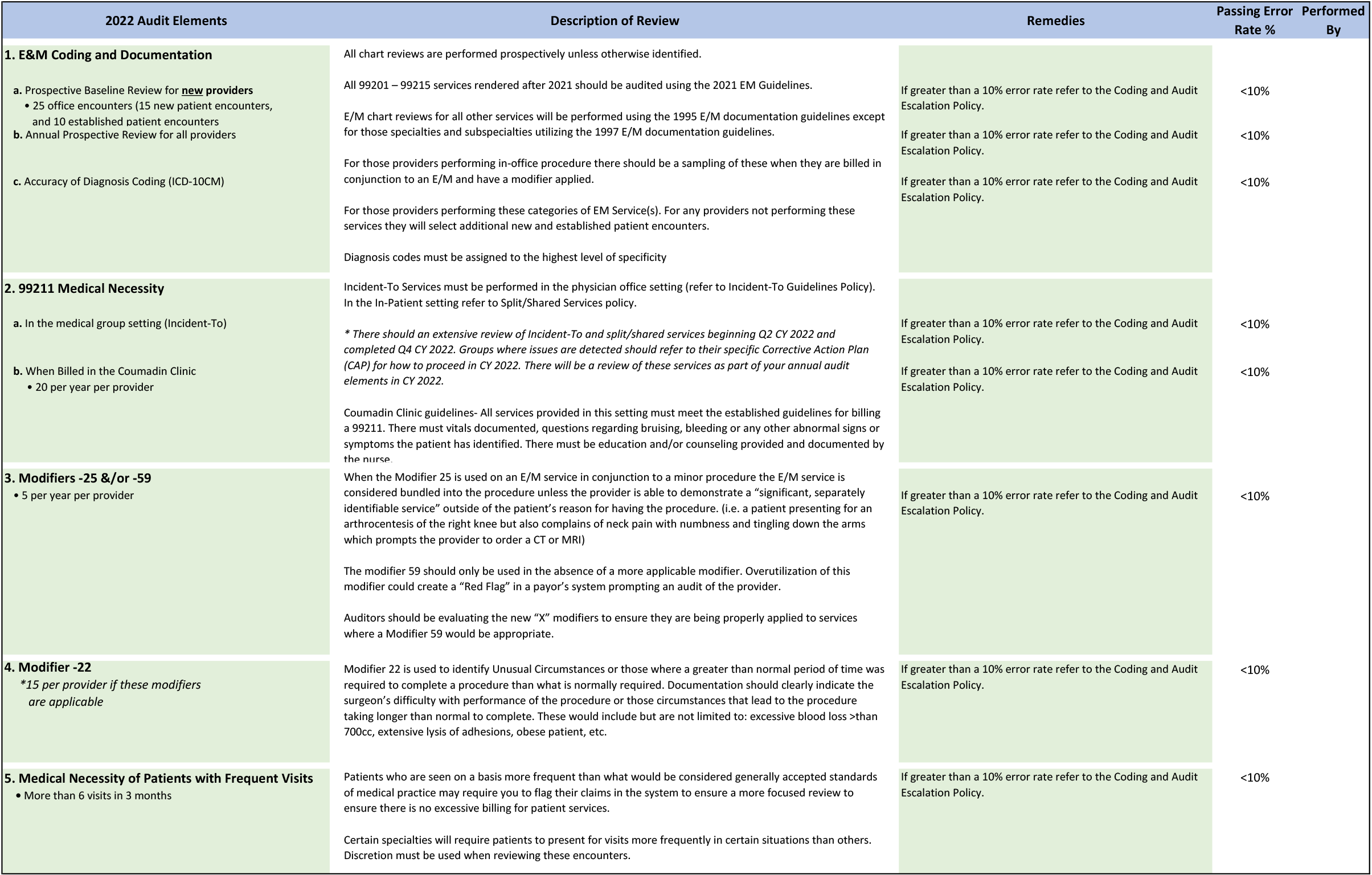

Below, I have provided for you an Audit Elements Guide that you can use within your practice/organization to aid in determining the What, When, Where, and How of the audits that should be conducted and how to do it in a way that demonstrates a “Good-Faith” effort to governmental agencies/investigators whose singular focus is on recoupment and/or indictment.

You will notice that on the Audit Elements Guide provided, I only selected five (5) areas of focus, but they are significant areas of focus because of past audit outcomes and indictments sought by prosecutors:

- Evaluation and Management Services – Again, focus on all levels new and established;

- Modifiers – Focus on those applicable to your practice/organization;

- Incident-To and Split Billing Services – This is an area that continues to provide the biggest headaches;

- 99211 for Coumadin Clinics – There are very specific guidelines that must be followed for these services; consult with your MAC and/or commercial payor guidelines;

- “Medical Necessity” – Remember that this is the overarching criterion used in addition to the individual elements of the CPT® codes(s)

Remember, at the end of the day this is your Audit Elements Guide and something that needs to be specific to your practice/organization to ensure you are not leaving any stone unturned. Taking the time to do things right and to be as precise as possible will make all the difference during an investigation.